What's New

News

Review of Import Declaration Items and Customs Office Manager System

We are Murata Sogo Tax & Accounting office. Today we are going to elaborate "Review of Import Declaration Items and Customs Office Manager System" to businesses who are doing import activities.

1. Overview

With the expansion of cross-border EC against the backdrop of the Corona disaster nest egg demand and other factors, imports of mail-order cargo and other goods have been increasing. There have been an increasing number of cases of smuggling of illicit drugs and intellectual property infringing goods by air cargo, etc., and cases of import declarations with inappropriate taxable prices for cargo using the fulfillment services (FS) of EC platform operators, as well as cases of non-residents using the name of a domestic resident with an import record without permission. There have been cases of non-residents importing goods by “spoofing,” in which they use the name of a domestic resident who has a history of importing goods. There have also been cases of import declarations at unreasonably low prices and evasion of customs duties, etc., where no sale or purchase was concluded at the time of importation and no transaction price existed.

Against this background, the system was reviewed to ensure continued smooth importation, to ensure the effectiveness of border control, and to realize appropriate taxation.

2. Details of Amendment

(1) Effective October 1, 2023

In addition to clarifying the meaning of “import declarant,” the amendment will allow the Directors-General of Customs to require non-residents to notify the customs office manager by a specified deadline if the customs office manager has not been notified by the deadline. Also, if a non-resident does not notify a customs administration manager by the deadline, the Director of Customs may designate one.

|

・The “name and address of the importer,” which is required to be stated at the time of import declaration, is added to the import declaration items in the Order for Enforcement of the Customs Tariff Law. |

|

・In line with the addition of “the address and name of the importer,” the meaning of “import declarant” (a person who intends to import goods) has been clarified. |

|

・The Customs Administrator shall request non-residents, etc. to submit a notification, etc., and shall request non-residents, etc. to select a customs office administrator. |

|

・The provisions were also established to allow the Director-General of Customs to designate a certain domestic affiliated person of a non-resident as a customs office manager when the non-resident does not respond to the request by the deadline. |

(2) Effective October 12, 2025

The following items were added to the import declaration items

|

・Whether or not the shipment falls under the category of mail-order shipments |

|

・If it is a mail-order shipment, the name of the platform |

|

・Address and name of the place of carriage of the shipment after the import license has been granted. |

(3) Clarification of the Significance of Import Declarant

The import declarant (a person who intends to import goods) is required to understand the information pertaining to imported goods and to make an appropriate import declaration responsibly, and the meaning of import declarant has been clarified in accordance with the provisions of the Basic Notification of the Customs Tariff Law (Basic Notification 67-3-3 2(2) of the Basic Notification of the Customs Law).

・The meaning of “import declarant” is clarified in accordance with the provisions of the Basic Notification of the Customs Law (Basic Notification 67-3-3-2(2) of the Customs Law).

・In cases other than the above, the term “person who imports goods” shall mean a person who, at the time of import declaration, has the authority to dispose of imported goods after domestic pickup, and shall include a person who performs an act for the purpose of importation other than that person, if there is any such person.

<Examples of persons who perform acts for the purpose of importation>

・Goods imported under a lease contract: A person who rents and uses the goods

・Goods imported for the purpose of consignment sales: A person who sells the goods on consignment.

・Goods imported for processing or repairing are those which are processed or repaired.

・In the case of goods imported for destruction, the person who destroys the goods

(4) Cases

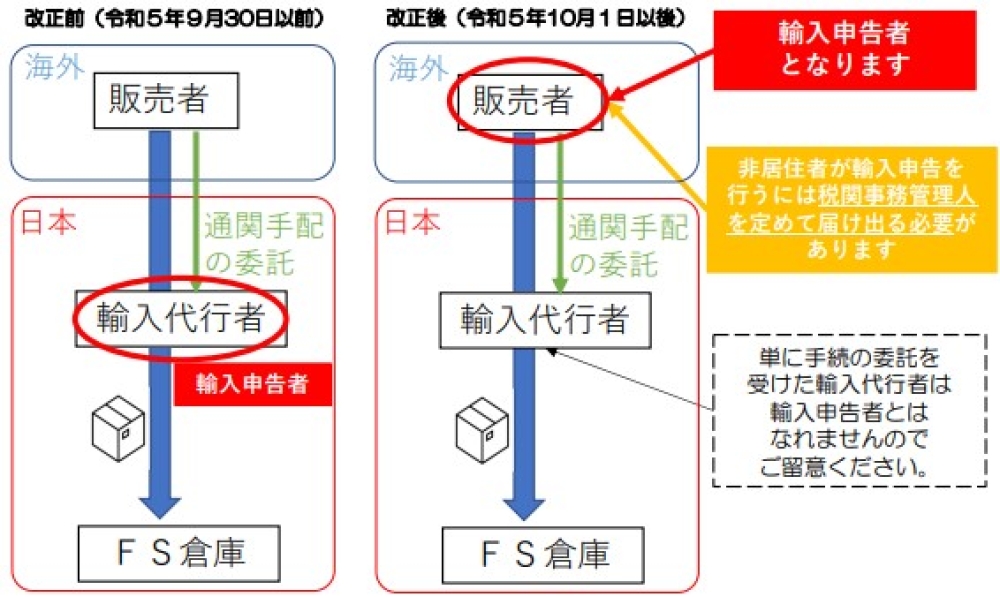

When goods sold by a non-resident seller are imported with the intention of selling them domestically using FS provided by an EC platform operator, the seller who becomes the main seller after taking delivery in Japan becomes the import declarant. The difference between before and after the amendment is as shown in the following chart.

[Chart] Examples of changes in the import declarant

Source: Customs, “Revision of Import Declaration Items and Customs Office Manager System.

3. Possible Effects of the Amendment on Consumption Tax

In addition to taxable purchases made in Japan, taxable goods taken from bonded areas are subject to the credit for consumption tax on purchases. The business entity that should receive a credit for the amount of consumption tax imposed or to be imposed on taxable goods taken from bonded areas is the person who took delivery of such taxable goods, i.e., the person who filed an import declaration, in accordance with the provisions of Article 30 of the Consumption Tax Act (Deduction of Consumption Tax on Purchases).

Therefore, the “import declarant” is supposed to receive the credit for taxable purchases. However, in the case of Chart 2, the import agent who is the import declarant was allowed to receive the credit for taxable purchases unless the case falls under Basic Notification 11-1-6 of the Consumption Tax Act (Treatment of Cases in which the actual importer and the import declaration holder are different). The revised law provides that the import agent who is the importer may receive the purchase tax credit as long as it does not fall under the following conditions. After the amendment, the seller, who is the person authorized to dispose of the goods, will be considered the import declarant, i.e., the person to whom the purchase tax credit is applied.